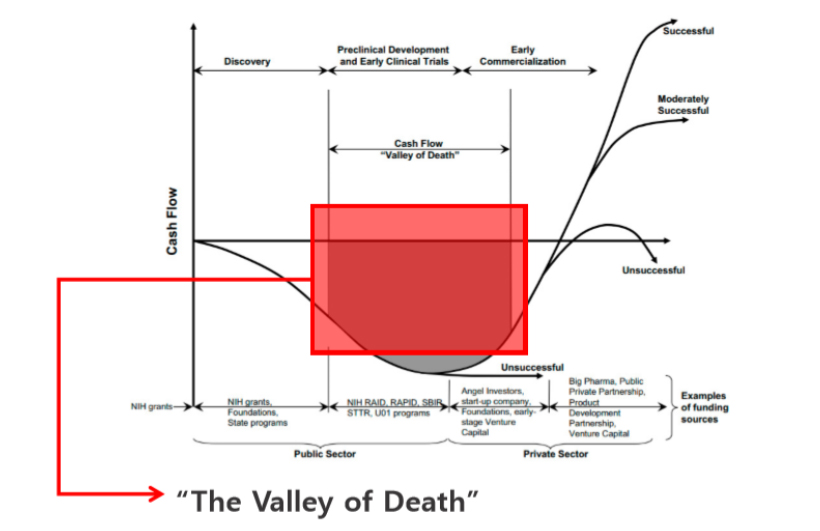

How to Navigate the Valley of Death

The Valley of Death may come 3 years after incorporation in the stage of GLP tox/safety.

Phase Ⅰ requires $ 1~2M / years, 5 years~ (in case of Korea).

Possible solutions

ⅰ) Special listing of excellent technology companies on the KOSDAQ

ⅱ) Investment from VC and Angel Awarded by Government Grant

ⅲ) Early Stage Licensing-Out M&A

Ref-: The basics of preclinical drug development for neurodegenerative disease indications. Steinmetz KL, Spack EG - BMC Neurol (2009),